Core Banking

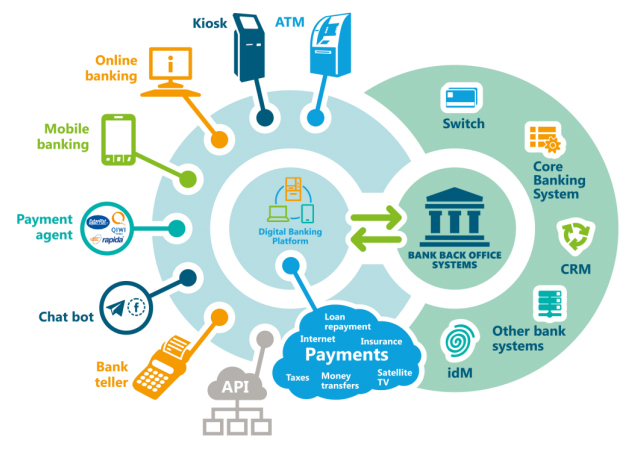

Core banking system as can be defined as a back-end system that processes banking transactions across the various branches of a bank. The system essentially includes deposit, loan and credit processing. Among the integral core banking services are floating new accounts, servicing loans, calculating interests, processing deposits and withdrawals, and customer relationship management activities.

Core banking systems are aimed at empowering existing and probable customers to have a greater freedom of their account transactions. With technological evolutions, transactions are now safer and faster. The fact that these transactions can be executed remotely, from any part of the world has made core banking systems a significant aspect of banking these days.

Core banking always brings down operational costs considerably, ensuring lesser manpower requirement for execution. It also enables greater accountability of the customers. Software application based platforms make core banking systems user-friendly and more efficient. The benefits of core banking systems are multi-faceted – keeping pace with fast-evolving market, simplifying banking processes and making it more convenient for the customers, and expanding the outreach of the banks to remote places.

Nishriyan Solutions offers unique core banking solutions to its clients, bringing about a comprehensive evolution in legacy banking functions.